What is a PPP Loan?

The pandemic relief for small business owners is no longer available, but forgiveness is still an option for those who benefited.

The Paycheck Protection Program (PPP) is a federal program created by the Coronavirus Aid, Relief and Economic Security (CARES) Act in March 2020. The program allowed small business owners to obtain up to two forgivable loans to cover payroll and other eligible expenses during a time of economic uncertainty.[1-2]

Here’s what to know about PPP loans and what other options are available for small businesses that need funding.

Is the PPP loan program still open?

The U.S. Small Business Administration (SBA) stopped taking applications for PPP loans on May 31, 2021. So, if your small business is struggling, a PPP loan is no longer an option.[2]

That said, if you received one or two PPP loans when the program was still open, you can still apply for forgiveness.[2] More on that in a minute.

What is a PPP loan?

The PPP loan program was a $953 billion program that provided targeted relief to struggling small businesses at the height of the coronavirus pandemic.[3]

Loan details

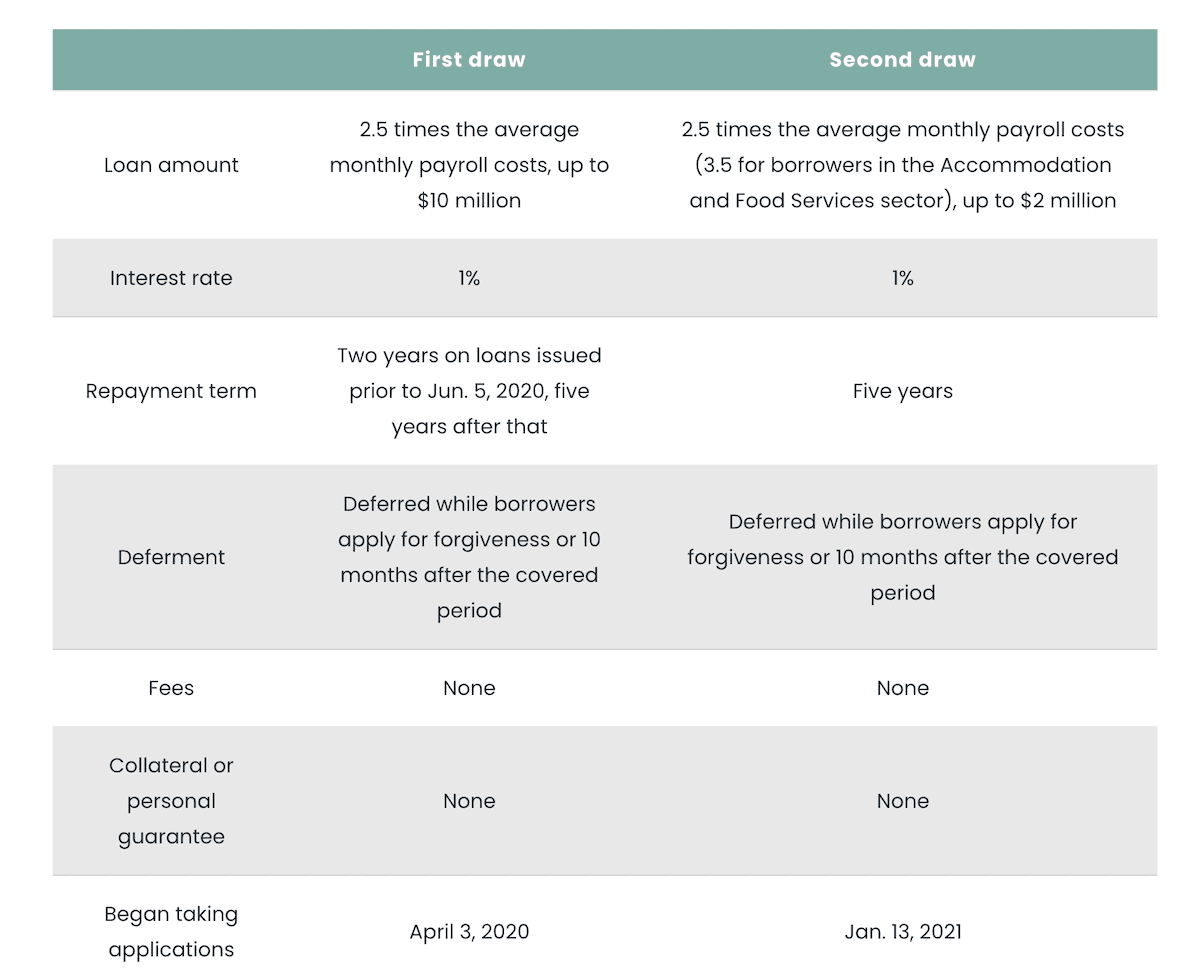

Business owners could apply for up to two loans in separate draws, each meant to cover payroll and other eligible costs for eight to 24 weeks.[4-5] For those who qualified, the loan terms were standardized regardless of the lender or the borrower[4-8]:

Eligibility

The PPP loan program helped small business owners cover certain eligible expenses, including[4]:

Payroll costs (with benefits)

Mortgage interest

Rent

Utilities

Worker protection costs related to COVID-19

Uninsured property damage costs caused by looting or vandalism during 2020

Certain supplier costs and expenses for operations

“One of the best qualities of the PPP loan program is that it was relatively easy for eligible businesses with under 500 employees to qualify,” says Armine Alajian, a Certified Public Accountant and founder of Alajian Group, an accounting firm that specializes in startup management.

To determine whether your business qualified for a first-draw loan, the SBA provided the following list of eligible businesses[4]:

Sole proprietors, independent contractors and self-employed persons

Any small business concern that meets SBA’s size standards

Any business, 501(c)(3) non-profit organization, 501(c)(19) veterans organization or tribal business concern (sec. 31(b)(2)(C) of the Small Business Act) with fewer than 500 employees, or that meets the SBA industry size standard if more than 500 employees

Any business with a NAICS code that begins with 72 (Accommodations and Food Services) that has more than one physical location and employs less than 500 per location

The second draw was limited to those who had already received a first-draw PPP loan and:[7]

Already used or had plans to use the full loan amount for authorized expenses only

Had no more than 300 employees

Could demonstrate at least a 25% decrease in gross receipts between comparable quarters in 2019 and 2020

How to obtain PPP loan forgiveness

If you received one or both PPP loans, your business may be eligible to have the full amount forgiven by the SBA. To qualify for forgiveness, you must meet the following criteria:[9]

Maintain employee and compensation levels during the covered period of eight to 24 weeks

Use the loan funds for payroll costs and other eligible expenses

At least 60% of the funds were used to cover payroll costs

Some small businesses that haven’t applied for forgiveness may have already started making payments. But if you believe you’re eligible for forgiveness, you can still apply for it up until the end of the repayment term.[9]

“If you received PPP funds and intend to apply for forgiveness, you most definitely do not want to dilly dally,” says Alajian.

Depending the original source of your PPP loan, you may need to apply for forgiveness directly through the SBA or through your lender. You can use the SBA’s list of lenders that offer direct forgiveness through the SBA to find out where to start.[9]

If you can apply for direct forgiveness, visit the SBA’s forgiveness portal to start the process. If not, contact your lender and request the required application forms. Note that you’ll need to provide some documentation to prove that you’re eligible for forgiveness. You can find a list of documents on the SBA’s website.[9]

Those applying for direct forgiveness typically receive a decision within a week, but it could take longer if you need to go through your lender—it’s allowed to take up to 60 days for review.[10-11]

What to do if you need funding for your small business

If your small business is struggling, there are currently no federal programs like the Paycheck Protection Program available to help. However, you may be able to apply for financing in the form of:

Term loans

Lines of credit

SBA loans

Business credit cards

Invoice financing

Merchant cash advances

Crowdfunding

Each of these options varies in how it works and the eligibility requirements. In many cases, though, it can be challenging to get approved if your business is brand new, you don’t have an established business credit history or your personal credit score is in poor shape.

Research small business financing options in your area and through online lenders to learn more about what’s available.

Article from: https://www.sounddollar.com/ppp-loan

Sources

- “SBA’s Paycheck Protection Program for Small Businesses Affected by the Coronavirus Pandemic Launches,” SBA, April 3, 2020, https://www.sba.gov/article/2020/apr/03/sbas-paycheck-protection-program-small-businesses-affected-coronavirus-pandemic-launches.

- “Paycheck Protection Program,” SBA, https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program.

- “The Paycheck Protection Program in New York City: What’s Next?” Oversight.Gov, https://www.oversight.gov/report/state-local/NY/Paycheck-Protection-Program-New-York-City-What%E2%80%99s-Next.

- “First Draw PPP loan,” SBA, https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program/first-draw-ppp-loan.

- “Paycheck Protection Program Second Draw Loans,” SBA, https://www.sba.gov/sites/default/files/2021-01/Top-line%20Overview%20of%20Second%20Draw%20PPP%20%281.8.2021%29-508.pdf.

- “Paycheck Protection Program,” SBA, March 12, 2021, https://www.sba.gov/sites/default/files/2021-03/HowtoCalculateFirstDrawLoanAmountsFAQs-3.12.21-508.pdf.

- “Second Draw PPP loan,” SBA, https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program/second-draw-ppp-loan.

- “Business Loan Program Temporary Changes; Paycheck Protection Program Second Draw Loans,” SBA, https://www.sba.gov/sites/default/files/2021-01/PPP%20–%20IFR%20–%20Second%20Draw%20Loans%20%281.6.2021%29-508.pdf.

- “PPP loan forgiveness,” SBA, https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program/ppp-loan-forgiveness.

- “In Less Than Two Weeks, Paycheck Protection Program Direct Borrower Forgiveness Portal Surpasses Expectations, Accepts More Than 340K Submissions,” SBA, Apriil 18, 2021, https://www.sba.gov/article/2021/aug/18/less-two-weeks-paycheck-protection-program-direct-borrower-forgiveness-portal-surpasses-expectations.

- “SBA Procedural Notice,” SBA, https://home.treasury.gov/system/files/136/PPP–Procedural-Notice–PPP-Borrower-Resubmissions-Loan-Forgiveness-Applications-Using-Form-3508S-Lender-Notice-Responsibilities-PPP-Borrowers-TOP-Offset-Remittances.pdf.

- “About COVID-19 EIDL,” SBA, https://www.sba.gov/funding-programs/loans/covid-19-relief-options/covid-19-economic-injury-disaster-loan/about-covid-19-eidl.

- “PPP Loan Forgiveness Application Form 3508S,” SBA, July 30, 2021, https://www.sba.gov/sites/default/files/2021-07/PPP%20–%20Forgiveness%20Application%20and%20Instructions%20–%203508S%20%287.30.2021%29-508.pdf.