What Is a Profit and Loss Statement?

Being a business owner comes with tough decisions. Should you sell your business now? Is merging with another company a good idea? Is it time to seek investors, or should you try to self-fund a little longer?

These are common crossroads founders come to — but to pick the right path, you need to know whether your business is financially stable. This is possible using a document called a profit and loss statement.

Creating one correctly will help with your company’s accounting and give investors a good overview of your startup’s financial performance. Keeping a good track of the statements will also help you spot patterns and project future earnings.

What is a profit and loss statement?

A profit and loss statement, or P&L, is a financial document showing a business’s monthly, quarterly, or yearly revenue, profit, and losses. It identifies a company’s financial health for internal decision-making, or entices buyers and investors to purchase or fund the business.

Is an income statement the same as a profit and loss statement?

Income statements. Profit and loss statements. Balance sheets. While these terms are commonly thrown around, they’re not all interchangeable.

“An income statement is known as a P&L statement,” says Francis Fabrizi, an accountant at Keirstone Limited. “There’s no difference between the two, whereas a balance sheet provides a quick overview of the company’s [entire] financial information. This is usually a broader view showing assets, liabilities, and income. However, an income statement is more useful in showing specific cash flow details.”

How to do a profit and loss statement

There are two ways to complete a profit and loss statement: use accounting tools like Freshbooks, or do it manually with software like Excel.

Fabrizi recommends cloud-based accounting software like Xero or QuickBooks, which allow users to audit or create P&L statements quickly. “Most of the calculations are automated from receipts and invoices, so it’s less likely for anything to be overlooked or miscalculated.”

Plus, software tools often offer various statement formats like bar charts and line graphs, making it easier to see trends and make business decisions.

But regardless of how you compile it, there are six key areas to include in a P&L statement:

- Revenue

- Cost of goods sold (COGs)

- Operating expenses

- Gross profit (or loss)

- Operating profit (or loss)

- Net profit (or loss)

1. Revenue

The revenue section of a profit and loss statement includes all the income your business receives from day-to-day operations.

“This covers the sale of goods and services, and other sources of income, such as the disposal of used office supplies,” says Fabrizi.

Before calculating your total income, determine the time frame you’re calculating for. If it’s quarterly, then add all the sales generated during those three months to get accurate revenue figures.

For example, if your shop reeled in:

- January: $5.7k

- February: $10.3k

- March: $3.5k

Then your total net sales is $19.5k.

2. Cost of goods sold (COGS)

The cost of goods sold is the amount you spend on materials to operate your business. For example, purchasing inventory to manufacture or sell products, or machinery to perform a service for customers.

“If you own a cafe and charge $2.50 for a coffee to go, your profit isn’t $2.50. Costs like the price of the coffee beans and the takeout cup must be subtracted. Another illustration: You need to account for supplier costs; if you sell an item, you don’t make it yourself,” Fabrizi explains.

Indirect costs (e.g. rent, accounting, and marketing) that are not expressly associated with the creation of services and goods are not part of COGS, notes Fabrizi. These fall under additional expenses or operating costs.

For this example, suppose the COGS is $5.5k.

3. Operating costs

Under this bucket, you’ll calculate how much you spend on resources to maintain daily business operations. This includes spending for:

- Employee salaries

- Business rent and utilities (business phone, office space, etc.)

- Depreciation of company equipment (computers, office furniture, vehicles, etc.)

- Administrative fees (insurance, office supplies, and other items not directly connected to specific goods or functions)

Add everything together to get a total. Say, in this example, the amount comes out to $2.2k.

4. Gross profit (or loss)

Gross profit is how much a business earns after subtracting COGs. The formula:

Revenue – COGS = Gross Profit

So in this scenario:

$19.5k Revenue – $5.5k COGS = $14k Gross Profit

5. Operating profit (or loss)

Operating profit is the total your business gets after deducting COGS and additional expenses. You’ll need to calculate your gross profit, minus what you spent on rent, salaries, admin fees, etc.

The formula:

(Revenue – COGS) – Operating Costs = Operating Profit

So in this example:

($19.5k – $5.5k) = $14k Gross Profit

$14k – $2.2k Operating Costs = $11.8k Operating Profit

The operating profit is $11.8k, and the total expenses are $7.7k (COGS + Operating Costs).

6. Net profit (or loss)

Net profit is the amount your business earned minus COGS, operating costs, debt interest, and taxes. In other words, it’s the total revenue minus all costs, and signifies what eventually ends up in the company’s coffers.

To calculate, take your operating profit and subtract taxes and interest from debts (e.g., business lines of credit, loans). The formula:

Operating Profit – (Debt Interest + Taxes) = Net Profit

So if the total for debt interest and taxes is $4k in this example:

$11.8k Operating Profit – $4k Debts and Taxes = $7.8k Net Profit

If your total was negative, you’d have a net loss instead of a net profit.

How to read a profit and loss statement

The purpose of reading a P&L statement is to determine the profitability of a business. You’ll have to review the P&L statement line by line to identify if the company is running at a loss (and won’t owe any taxes) or netting a profit.

Before you start, determine the period of the statement (month, quarter, year) to get a clearer picture of the company’s finances.

Next, determine if the accounting method is:

- Cash basis: Income and expenses are reported immediately when they occur

- Accrual basis: Income and expenses are reported even if money hasn’t exchanged hands yet

This matters because accruals may not occur until months later, affecting the actual income or expenses in a given time period. For example, earning $55k for the quarter (cash basis) and having $15k in unpaid invoices for projects already completed.

When you add it together, you get an income of $70k. But if you don’t receive the $15k until three months later, you may miscalculate what you can spend on expenses for the quarter, landing you in a deficit.

Profit and loss statement example

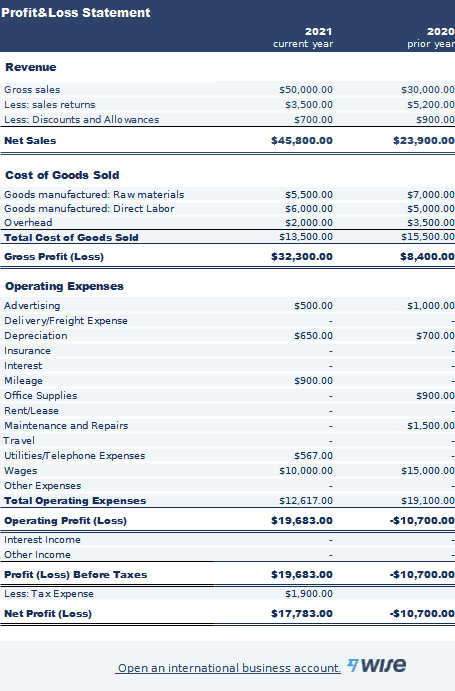

Here’s an example of a P&L statement.

In 2020, you see a net loss of $10.7k. Then in 2021, the business improved, earning a net profit of $17,783.

Check the math line by line to ensure accuracy if you’re reviewing a manually created profit and loss statement. Using software reduces human error and time spent on calculations.

As you review, note areas where you can cut costs to increase profits. For instance, performing more maintenance on equipment to prevent costly breakdowns. Or switching to a cheaper insurance provider or office space.

Audited vs. unaudited profit and loss statement

Having your P&L statement audited by a licensed CPA helps ensure accuracy. Plus, investors and banks often request an audited P&L before agreeing to invest in or fund your business.

“One of the biggest mistakes business owners make when preparing their own P&L statements is not putting the correct type of revenue and expenses on the statement,” says Amine Alajian, CPA and founder of the Alajian Group, an accounting firm for startups.

“Assuming that all money that comes in is revenue and all money that comes out is an expense is incorrect. For example, if you get money for a loan, that’s a liability, not revenue. Along those same lines, when you pay that loan back, that’s not an expense and should not go on the P&L.””

Now, don’t think of a P&L audit as a bad thing. It’s not like when the IRS comes to review your financial statements. It provides an extra pair of experienced eyes to review your finances to prevent reporting mistakes and to instill confidence in stakeholders and investors.

“An audit is usually performed when a bank wants to lend a large amount of money, or a company is being acquired. Additionally, investors require an annual audit to assure their investment is being properly reported,” says Armine.

If you’re a business owner looking to grow, keep a close eye on your profits and losses. Consider using software to increase the speed and accuracy of financial reporting. Then if you decide to sell or seek investments, you’ll have the proof needed to negotiate the best deal.