CPAs vs CFAs: Which is More Suitable for your Company?

As a business owner, making informed decisions about your financial team is critical. You likely understand the importance of strong accounting practices, but navigating the world of financial certifications can be a challenge.

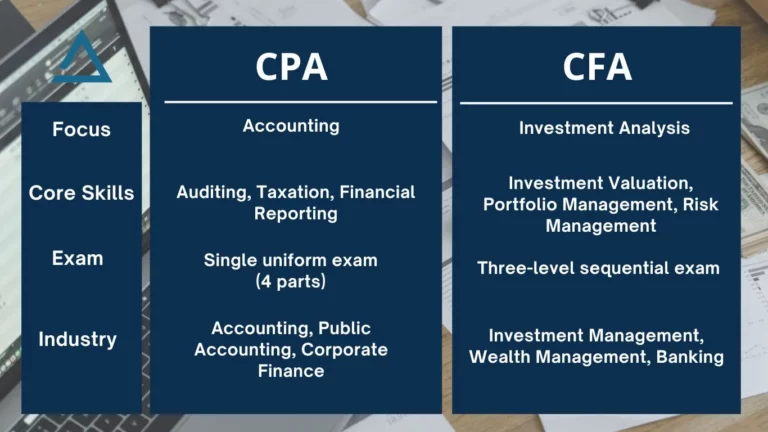

Two prominent designations often cause confusion: Certified Public Accountant (CPA) and Chartered Financial Analyst (CFA). While both are highly respected professionals, their skill sets cater to different aspects of your company’s financial needs. Let’s delve into the key differences between CPAs and CFAs to help you decide which best fits your business.

The Role of a CPA, The Accounting Guardian

A Certified Public Accountant, or CPA, is a licensed professional who has demonstrated expertise in accounting principles, auditing procedures, tax law, and financial reporting. CPAs play a vital role in ensuring the accuracy and transparency of financial information used by businesses, investors, and government entities.

Think of a CPA as your financial watchdog. Their expertise lies in ensuring the accuracy and compliance of your financial records. Here’s how a CPA benefits your business:

- Maintaining Accurate Records: CPAs possess a deep understanding of accounting principles and ensure your books are up-to-date and reflect the true financial health of your company.

- Tax Compliance: Navigating the complexities of tax regulations can be a nightmare. CPAs stay updated on tax laws and ensure your business adheres to all filing requirements, saving you from costly penalties.

- Internal Audits: Regular internal audits conducted by a CPA can identify potential issues in your accounting system, preventing fraud and safeguarding your assets.

- Financial Reporting: CPAs can generate clear and concise financial statements that provide valuable insights into your company’s performance and financial health.

Schedule a Consultation Today for Tailored Accounting Solutions!

The Role of a CFA, The Investment Strategist

A Chartered Financial Analyst, or CFA, is a designation earned by individuals who have mastered the art of investment analysis and portfolio management. CFAs are highly skilled in asset valuation, risk assessment, and formulating investment strategies. They play a crucial role in driving financial decision-making within the investment management industry.

While a CPA focuses on the internal financial landscape, a CFA brings an external perspective. Their expertise lies in investment analysis and portfolio management. Here’s how a CFA can add value to your business:

- Investment Decisions: If your company has significant investments, a CFA can provide expert advice on portfolio optimization, risk management, and identifying potential investment opportunities aligned with your business goals.

- Financial Modeling: CFAs are skilled in creating financial models that forecast future performance and assess the financial viability of potential ventures.

- Mergers and Acquisitions: During mergers and acquisitions, a CFA can analyze the financial health of target companies and provide valuable insights for negotiation and due diligence.

What Does your Company Need, CPA or CFA?

Both CPAs and CFAs can be valuable assets for companies and startups managing their finances.

- CPAs: Essential for ensuring accurate financial reporting, compliance with tax regulations, and conducting internal audits.

- CFAs: Offer valuable insights for investment decisions, risk management strategies, and portfolio optimization.

When hiring a CPA for your firm, look for individuals with experience relevant to your industry and specific needs. Consider their qualifications, including relevant licenses, certifications, and professional affiliations.

The decision between a CPA and CFA hinges on your specific needs:

- Focus on core accounting, tax compliance, and maintaining accurate financial records? A CPA is the ideal choice.

- Actively manage investment portfolios or consider strategic acquisitions? A CFA’s expertise can be invaluable.

Many businesses benefit from having both a CPA and a CFA on their financial team. However, if budget constraints limit you to one professional initially, consider your company’s current stage and priorities.

Remember, a qualified CPA can also offer valuable guidance on basic investment strategies and risk management. On the other hand, a reputable financial advisor might have a team that includes both CPAs and CFAs, offering a comprehensive financial service for your business.

Wrapping Up

Regardless of your choice, prioritize experience and qualifications. Look for professionals with a proven track record in their field and certifications relevant to your industry. A clear understanding of your company’s financial goals will help you determine the best fit for your team, ensuring strong financial stewardship for your business.