What is the Difference Between Pre-Tax vs. Post-Tax Deductions

Withholding wages for employee benefits is a crucial aspect of payroll processing. However, navigating pre-tax and post-tax deductions can be confusing. This article aims to demystify these terms for company owners and HR professionals, ensuring accurate withholding and a clear understanding of their impact on employee finances and taxable income.

What are Pre-Tax Deductions?

Pre-tax deductions refer to contributions withheld from an employee’s gross pay before calculating federal income tax, Social Security, and Medicare taxes. This effectively reduces the employee’s taxable income, lowering their overall tax burden.

According to the Internal Revenue Service (IRS), common examples of pre-tax deductions include:

- Health insurance premiums (medical, dental, vision)

- Dependent care FSA contributions (Flexible Spending Account)

- Group-term life insurance premiums (up to a certain limit)

- Retirement savings contributions (traditional 401(k), traditional IRA)

Impact on Taxable Income: By reducing gross income, pre-tax deductions directly decrease the amount of income subject to federal and state income taxes. This translates to a higher take-home pay for the employee.

Pre-Tax Example: An employee earns a gross salary of $5,000 per month. They contribute $200 towards health insurance premiums (pre-tax). Their taxable income becomes $4,800, resulting in lower tax withholdings and a higher net pay.

What are Post-Tax Deductions?

Post-tax deductions are contributions withheld from an employee’s gross pay after calculating federal income tax, Social Security, and Medicare taxes. Unlike pre-tax deductions, they do not affect taxable income.

Here are some common examples of post-tax deductions:

- Health savings account (HSA) contributions

- Parking fees

- Transit benefits (depending on the plan)

- Charitable contributions (though employees can claim these as deductions on their tax return)

- Union dues

Impact on Taxable Income: Since post-tax deductions are taken out after taxes are calculated, they do not reduce taxable income. The employee pays taxes on the full amount of their gross income before the post-tax deduction is withheld.

Post-Tax Example: An employee earns a gross salary of $5,000 per month. They contribute $100 towards a parking pass (post-tax). Their taxable income remains $5,000, and their net pay reflects the post-tax deduction of $100.

Major Differences and Considerations for Pre-Tax vs. Post-Tax

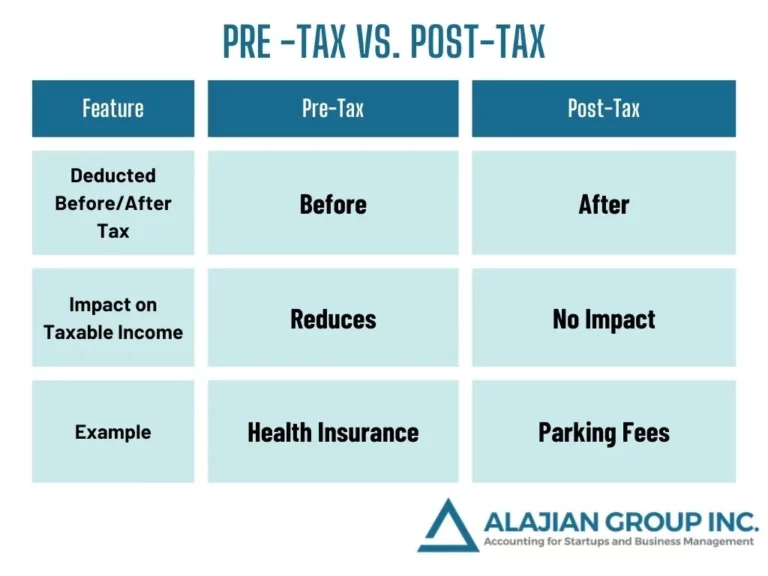

The key difference between pre-tax and post-tax deductions lies in their impact on taxable income. Pre-tax deductions lower taxable income, resulting in immediate tax savings for the employee. Post-tax deductions, however, do not affect taxable income and provide no immediate tax benefit.

Additional Considerations:

- Employee Choice: Some benefits, like health savings accounts (HSAs), allow employees to choose pre-tax or post-tax contributions.

- Tax Implications: Employers should consult with a tax advisor to understand any tax implications associated with offering specific pre-tax or post-tax benefit options.

How to Calculate Pre-Tax and Post-Tax Deductions

Understanding the formulas for calculating pre-tax and post-tax deductions ensures accurate withholding and employee net pay.

Calculating Pre-Tax Deductions

Pre-tax deductions reduce an employee’s taxable income, lowering their tax burden. Here’s the formula:

Adjusted Gross Income (AGI) = Gross Pay – Pre-Tax Deductions

Example: An employee earns a gross salary of $5,000 per month and contributes $200 to health insurance (pre-tax).

Adjusted Gross Income (AGI) = $5,000 – $200 = $4,800

Calculating Post-Tax Deductions

Since post-tax deductions are taken out after taxes are calculated, they don’t affect taxable income. Here’s the formula to determine net pay after post-tax deductions:

Net Pay = Gross Pay – (Federal Income Tax + Social Security Tax + Medicare Tax) – Post-Tax Deductions

Note that calculating federal income tax withholding can be complex and involves tax tables or software. Consult a tax advisor or your payroll provider for specific guidance. Social Security and Medicare taxes typically have a fixed rate (7.65% combined) up to a certain income threshold.

Example: An employee earns a gross salary of $5,000 per month. Let’s assume a simplified flat tax rate of 20% for this example (consult a tax advisor for actual calculations). They also contribute $100 to a parking pass (post-tax).

Assuming the employee has already paid the Social Security and Medicare tax threshold:

Federal Income Tax = $5,000 * 20% = $1,000

Net Pay = $5,000 – ($1,000 + $0 + $0) – $100 = $3,900

Take Home Notes

- Pre-tax deduction amount is directly subtracted from gross pay to find adjusted gross income.

- Post-tax deductions are subtracted from net pay (after taxes are withheld) to determine the final take-home pay.

- Federal income tax withholding can be complex and depends on tax filing status, income level, and other factors.

By understanding these formulas and considerations, companies can ensure accurate payroll withholding for both pre-tax and post-tax deductions.